Project Financing

Get funded quicker

At SCGWest we understand the unique financing needs of businesses looking to improve their commercial spaces or build new facilities. That‘s why we offer a range of financing options to help you achieve your goals.

It is important to note, that SCGWest is neither a lender nor a broker. We are simply here to guide you through the process and take care of all necessary documentation and provide you the tools, resources, introductions, and administrative support to source the funding and financing options that are available.

SBA loan options

One of the most popular loans for small businesses and new locations is the SBA 7(a) loan. The SBA 7(a) is a commercial loan and is meant to help small businesses with expenses like real estate, working capital, or equipment. Like all loan programs, there are requisites that retail stores, medical clinics, and restaurants must meet to be considered eligible.

Businesses in the U.S. that are looking for funding can get the SBA 7(a) loan from a bank, credit union, or other lending institution, and the government guarantees the money up to a certain amount.

The straightforward requirements for the SBA 7(a) loan make it a great starting point to get funding for your business. Plus, the low interest rates and relatively fast approval process make it a prime option for retail, medical clinic, and restaurant owners.

Once a loan is approved, we are experts in the most efficient way to allocate that capital and realize the largest return on your investment.

Versatility is a good attribute to seek in a loan program, and the SBA 7(a) is full of it. You can use the loan to buy an existing store, medical clinic, or restaurant, replace or repair equipment, or even cover regular material expenses. Here’s a closer look at what you can use the SBA 7(a) for:

Equipment: This includes big, infrequent purchases like specific medical devices needed or exam room equipment like x-ray machines, MRI scanners, Defibrillators, EKG/ECG Machines or stretchers for medical office clinics. For restaurants this could include ovens, ranges, fryers, and freezers, as well as smaller, regular expenses like utensils, bar rags, and dish towels. Call us Today to learn more about How Can You Use the SBA 7(a) Loan for Equipment

Land and real estate: Whether you’re renting space, buying a building, or planning new construction on vacant land, you can use the SBA 7(a) loan to help pay for the physical space your retail store, medical clinic, or restaurant occupies.

Repairing existing capital: This could include new point-of-sale systems or software upgrades to existing ones, commercial vehicle repairs, or any other operating equipment that needs updating.

Similar in execution to the SBA 7(a), the 504 loan is a larger loan that usually goes with a commercial loan from a bank or other lending institution. The maturity for real estate and land is also shorter for the 504. These loans can be used to purchase commercial real estate for owner’s to occupy to run their business.

If you need a smaller amount of money than you would with the 504 or SBA 7(a), the Express loan is a good option. The 36-hour turnaround does come with a few drawbacks: higher maximum interest rates, lower SBA guarantees, and greater authority in the hands of the lender.

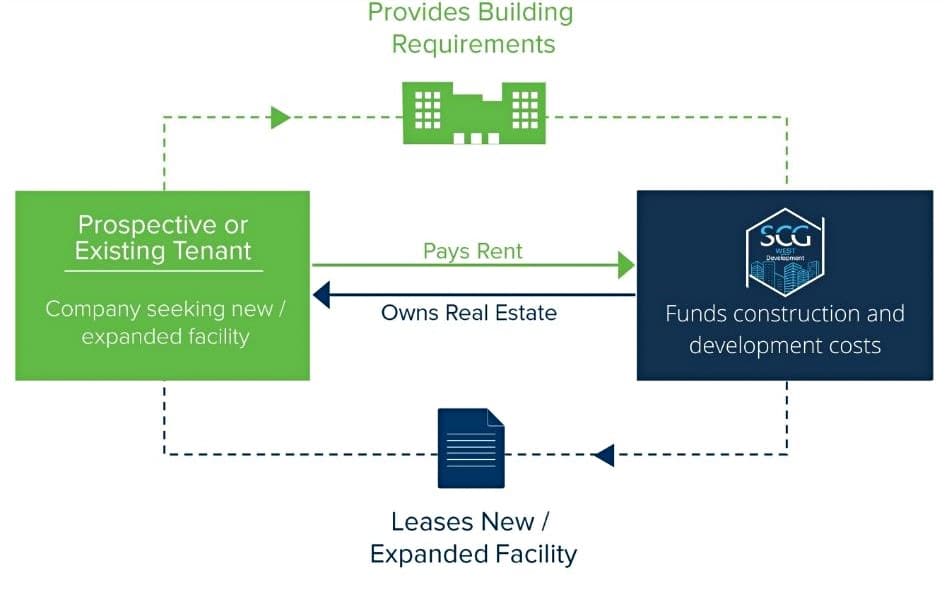

Development financing

In a build-to-suit development transaction, we will finance and fund the costs of the development and construction of your new facility or the expansion of an existing one to meet your exact specifications. Upon completion, you as the tenant enter into a long-term net lease while maintaining full operational control your new custom-built facility.

Our Build to Suit construction and development financing loans can fund up to 100% of project costs. This includes Ground-up projects including the land purchase and all direct project costs including both soft costs such as architectural design and engineering costs and hard costs such as construction, equipment and fixtures.

Financial

Services

- Financial modeling and analysis: The ability to create detailed financial models and analyze them accurately is essential for project financing. Our team of experts has extensive experience in financial modeling and analysis and can help you evaluate various financial scenarios to identify the best financing options.

- Capital stack structuring and optimization: Our team has expertise in structuring the capital stack in a way that maximizes the available financing options while minimizing the overall cost of capital. We work closely with our clients to identify the optimal debt-to-equity ratio and develop a financing plan that meets their specific needs.

- Investor relations and communications: Our team has extensive experience in investor relations and communication. We work closely with our clients to identify and approach potential investors, prepare investment memoranda and presentations, and communicate effectively with investors throughout the financing process.

- Debt and equity syndication: We have a proven track record of successfully syndicating debt and equity financing for a wide range of projects. Our team works closely with our clients to identify and approach potential investors, structure the financing package, and negotiate the terms of the financing agreement.

- Tax credit and incentive management: Our team has in-depth knowledge of tax credit and incentive programs, including federal, state, and local programs. We work with our clients to identify available tax credits and incentives and develop a plan to maximize their benefits.

- Risk management and mitigation strategies: Our team has extensive experience in identifying and managing financial risks associated with project financing. We work closely with our clients to develop risk management and mitigation strategies that protect their investments and ensure the successful completion of their projects.

Is your business eligible

for financing?

To be eligible for financing, businesses must meet certain requirements, including a minimum credit score and a proven track record of financial stability.

To apply for financing, simply fill out our online application form and provide the necessary documentation. Our team will review your application and get back to you with a decision as soon as possible.

Find the right financing option

- Short-term loans: Ideal for smaller projects or businesses with immediate funding needs.

- Medium-term loans: Ideal for larger projects that may take longer to complete.

- Build-to-suit financing: Designed specifically for businesses looking to build a new facility from the ground up.

Frequently AskedQuestions

We may be able to offer financing to businesses with less than perfect credit, but it will depend on a variety of factors including the business’s financial history and the amount of collateral available.

Yes, you can apply for financing online by filling out our application form.

We strive to make a decision on financing applications as quickly as possible, typically within a few days. However, the exact timeline may vary depending on the complexity of the application and the amount of documentation required.

Industry insights

We turn your vision

into a reality

Let SCG handle the complexities of your project, from site evaluation to design and construction.